To celebrate Insurance Day, Pakistan Insurance Institute (PII) organized a seminar on 6th April for students of Business Management and Actuarial Sciences in collaboration with Department of Accounts and Finance, Institute of Business Management.

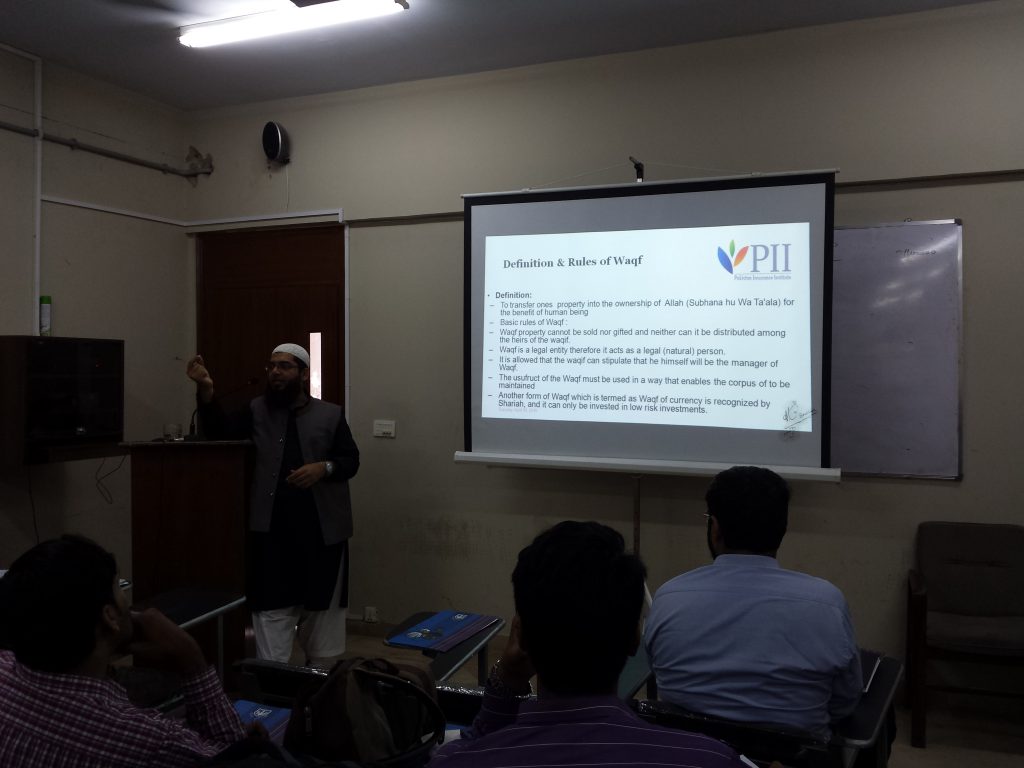

Mufti Zeeshan Abdul Aziz, Shariah Advisor and Faculty member PII delivered a presentation on “Takaful- Risk Mitigation in Islam”, to enrich the knowledge and understanding of Takaful, its historical roots, evolution, modern models and position of Takaful in global insurance industry. The difference between conventional insurance and Takaful, the Shariah compliant form of insurance was clearly explained with examples including Shariah principles and salient operational aspects. It was an informative and interesting presentation for the students.

This was followed by Student Presentations on the topic “Insurance Industry Today and Why I Would Choose Insurance As a Career?”

The students spoke well focusing on skill based jobs, sustainability, teamwork, diversity and opportunities for career advancement as reasons for opting for a career in this field. After listening to the presentations, some of the students expressed interest in choosing insurance as a career.

The participating students were awarded certificates from PII.

- all

In celebration of the Insurance Day 2018, Pakistan Insurance Institute (PII) organized a seminar for the Business School Department, University of Karachi. Mufti Zeeshan Abdul Aziz faculty PII conducted the seminar and explained ‘Takaful’ in a very simple manner.

The session was very well received by the participants and at the end of the seminar students raised questions to seek clarification / understanding of the topic which was ably handled by the speaker.

- all

In celebration of the Insurance Day Pakistan Insurance Institute (PII) organized a seminar for the Business School Department, University of Karachi. Mufti Zeeshan Abdul Aziz faculty PII conducted the seminar and explained ‘Takaful’ in a very simple manner.

The session was very well received by the participants and at the end of the seminar students raised questions to seek clarification / understanding of the topic which was ably handled by the speaker.

In celebration of the Insurance Day, Pakistan Insurance Institute (PII) organized a seminar for the M.Com students Department of Commerce, University of Karachi. Mufti Zeeshan Abdul Aziz faculty PII conducted the seminar and explained ‘Takaful’ in a very simple manner. Takaful is the Shariah-compliant alternative of conventional insurance which is based on “Aqd e Tabbaru” and is supervised by a competent and qualified Shari’ah Advisor / Shariah Supervisory Board which monitors and regulates every function and process of the operation to keep in line with the principles of Islamic Shari’ah.

Explaining the difference he stated that conventional insurance business is marred with socio-economic ills such as Riba, Gharrar, and Maysir, which are also harmful to society.

.

Takaful is a perfect loss-mitigation tool that can be used both by individuals and businesses alike, to meet their specific needs and requirements. Family Takaful deals directly with protecting a person from life-related financial losses whereas General Takaful deals with the non-life financial losses like theft of a car, fire or mishaps at home etc.

.

This is the basic foundation of Takaful. When you decide to become a member/participant, you regularly contribute a small amount called Contribution from your savings as “Taburru” or donation which is pooled into a Waqf Fund, also known as Participant Takaful Fund (PTF). This is like the Waqf of a Masjid that provides a place of worship and education to thousands of people and children. Whenever a member’s family is in financial trouble or any damage has been caused to member’s assets, the Waqf Fund comes to the rescue by compensating for their loss. This way it helps them to get over their immediate trouble and move on with their business activities and lives.

.

Obviously, as more and more people join Takaful, and the Waqf Fund gets bigger and bigger, we would need professional management to look after it who would manage the Waqf Fund (PTF) on the basis of Wakalah and would charge a certain Wakalah Fees as their service charges. It is important to know that Takaful is not only about protection. Yes, while Waqf Fund protects members/participants from financial losses incurring from untoward exigencies, a separate fund is known as Participant Investment Fund (PIF) existent in Family Takaful Operations also provides them with opportunities of making Shariah compliant investments and earning Halal returns at the same time. The Takaful Operator prudently invests in Shariah-compliant business avenues with the objective to increase the value of the Fund and also to give returns to its members/participants for their investments made into this particular Participant Investment Fund (PIF).

.

At the end of each year, the Waqf Fund (PTF) is evaluated and if there is any surplus (amount remaining in the Waqf after meeting all the expenses and the claims) in it, then that amount may be distributed among the members/participants as per the advice of Shariah Advisor.

The session was very well received by the participants and at the end of the seminar, students raised questions to seek clarification/understanding of the topic which was ably handled by the speaker.

- all

- Gallery

As part of the Insurance Day 2016 celebrations both possibilities and innovation in the insurance industry, were brought on display for the young graduating students of the Actuarial Sciences of the Department of Statistics, University of Karachi at the half day seminar organized by Pakistan Insurance Institute (PII) for the benefit of the students at the Department’s premises and invited young leaders of the insurance industry Mr. Saad Ullah Khan, VP head of Online Retail Jubilee General Insurance Company and Mr. Jalal H. Curmally Head of Human Resources EFU Life Assurance to share their experiences of the insurance industry.

In two back to back one hour sessions, the students were first made aware of the various innovations being undertaken by Jubilee life in its online retail area, by Mr. Saad Ullah Khan. After a round of active presentation and answer sessions, Mr. Curmally took to the stage to speak about career opportunities within the life insurance sector and the many possibilities that the students had available to them. He tackled head on some common conceptions and misconceptions about the life insurance sector. In an interactive question and answer based presentation, he highlighted the amazing growth opportunities that lay before the sector. The students asked if a career in life insurance meant sales, to which he was quick to highlight the many functions that go hand in hand to run a life insurance business and the career opportunities available in key roles, such as strategy, marketing, customer care, customer advisory, human resources and so on. He also highlighted how the life insurance sector was mainly comprised of young professionals and that it also is one of the highest employers of women professionals in the country.

Speaking directly then to students pursuing actuarial qualifications and careers, he laid out the career path for actuaries within EFU Life. He also answered questions related to benefits and pay that are currently being provided to actuaries. The session concluded with an open audience question and answer session with the students about how to enter the life insurance sector, how best to prepare for and conduct themselves in an interview and about career options available to students in general.

The day’s proceedings concluded with a vote of thanks from Professor Muhammad Aslam Chairman, Department of Statistics to PII and to the guest speakers. Lunch was also served at the conclusion of the proceedings.

- all

- Gallery

This was my first visit to Karachi University. Being part of this industry since past six years I had come with the intention to raise awareness on insurance and to encourage young girls to stand up for themselves in life as well as a professional. I was extremely delighted to see more than half of the crowd consisted of girls and that they all planned to make a career, not just study and sit home.

I commend the efforts put up by PII to organize this awareness campaign every year.Insurance Day celebration is a brilliant platform that PII and Karachi University conducts to bring students and insurance industry professionals’ together.

The event was well attended and as a guest speaker I along with my colleague Syed Abdul Mujeeb Manager EFU Life was pleased to see students open up and talk on their concerns on academics goals and career choices for brighter future, in the panel discussion. This session certainly sparked a lively interactive discussion amongst students, teachers, faculty members and guest speakers and played a significant role in the success of the event.

The best part of this insurance awareness seminar was we all took home new connections which strengthened the integration within the industry. Also, the seminar proved to enhance the young students’vision on potential career options within the insurance industry.

It was an honor to have been part of this event on behalf of EFU Life Assurance Ltd this year where we witnessed a lot of young energetic talent which has the potential to eventually take up most of the roles in Pakistan insurance industry in years to come.

Usha Nenwani

Manager EFU Life

- all

- Gallery

Pakistan insurance Institute organized a seminar on Insurance Industry & Career in Insurance at the University of Karachi with a contest, a survey and presentations by industry experts. The event was for the students and by the students of Departments of Statistics and of Commerce. They coordinated and moderated the programme which started with a survey on insurance awareness among the students

and the faculty. To gauge the students’ interest in insurance a contest on “Why would I choose insurance as a career?” followed, with award of prizes to the best speaker in each department.

These activities were balanced by informative presentations by industry experts on ‘career in life and non-life insurance’, followed by question-answer session by a panel to enable students to seek clarifications and have their queries answered. Volunteers from the insurance industry were also invited to informally mix with the students and have given an account of the proceedings for the readers:

Department of Statistics

“I was a volunteer at the second annual insurance seminar held on May 6, 2014 at the Department of Statistics, Karachi University. Although the weather in May is not generally conducive to hold such events, PII’s annual insurance day event turned out to be very well attended.

The seminar comprised a short student declamation contest on ‘Why would I choose insurance as a career’. Students had been selected to address the audience and they gave interesting perspective on insurance as a career. The visiting insurance industry panel commended the students for their demonstrated research and enthusiasm, and the panel gave marks on basis of content, confidence, delivery and timing; the student with the highest marks was given a prize.

This was followed by presentations by Captain Azhar Ehtesham Ahmed, Executive Director Alfalah Insurance who gave a biographical sketch of his career and his experiences in the general insurance sector, and Syed Ali Murtuza Hasan Senior Manager EFU Life Assurance shared his experience as an actuary in the life insurance industry since 2008.

The question-answer session which followed was very lively and often got multiple responses from panelists. The Chairman Department of Statistics Dr Mudassirrudin raised a question on how insurers deal with moral hazard and fraud. To this Mr Kamran Mazhar, Chief Operating Officer of ACE Insurance responded that underwriters assess both moral and physical hazard before committing to a risk. Other questions included queries on the applicability of normal distribution to different classes of insurance, surrender value of life insurance product and growth trends of the industry .The annual event is a great opportunity for industry professionals and academia to have a dialogue. In her closing remarks Ms Farzana Siddiq, Executive Director PII said that we can look forward to an even more interesting event next year, and closed the seminar with a vote of thanks to Dr Mudassiruddin, the faculty, students, and the event sponsor Jubilee General Insurance Company for making the event successful.”

Nabeel Turabi,

Property & Casualty Executive

ACE Insurance Limited

Department of Commerce

“The Insurance Day was celebrated on May 6, 2014 and Pakistan Insurance Institute conducted a seminar in the Commerce Department, University of Karachi for M Com (Insurance) students to guide / advice them regarding careers in Insurance.

The seminar started with the recitation of Holy Quran, followed by a contest amongst students on the topic “Why would I choose a career in Insurance”. All the students were very enthusiastic about the dynamics of Insurance industry and its connection to business. Students spoke and one of them was declared the winner on basis of effective points highlighted in his speech.

After the contest some prominent insurance executives spoke to students regarding career in Insurance and encouraged them to join the industry with full spirit and career planning. Executives were very keen to advise students about the positives that the Insurance industry offers which include learning on technical side as well as personal development.

Mr Uzair Mirza, Executive Vice President Jubilee General Insurance, who has also been visiting faculty at the University, took the opportunity to briefly address the students. This was followed by Mr Tahir Ahmed, Chief Executive Jubilee General Insurance, who advised students to increase their technical knowledge and abilities in order to foster their growth in the Insurance industry.

Mr Fawad Habib, Senior Manager EFU Life Assurance – having been a student of the M Com (Insurance) felt very much at home addressing the students – spoke of how satisfying his career in insurance was and at the same time cautioned students not to expect instant rise in position but to concentrate on gaining knowledge and experience for long-term growth.

Ms Zehra Naqvi, Chief Executive ACE Insurance, Pakistan highlighted the role of women in Pakistan insurance industry and encouraged female students to make a career in insurance, as the Insurance industry is an equal opportunity employer.

Mr Ayaz Gad, Chairman Karachi Insurance Institute spoke with great vigour telling the students about his own career in insurance industry and how it helped develop him and the benefits he has reaped. He added that even after retirement age you are in demand and can be engaged on contractual positions, giving you high measure of financial security not common in other careers.

Students then asked questions to the panel of Insurance executives to clear their concepts and ambiguities. Students asked questions regarding the role of sales and technical staff in the insurance industry, role of females and effective career route to success.

Mr M Vaqaruddin, Faculty Member of PII gave a vote of thanks to Dr Tahir Ali, Head of Department of Commerce, the faculty, students and the event sponsor Jubilee General Insurance Company for making the event a success.

It was a good experience to be part of PII team in celebrating Insurance Day at the University of Karachi and will be looking forward to continue this in future.”

Muhammad Waqas – ACII,

Vice President, Motor Department,

EFU General Insurance Limited

Highlights of presentation by some of the students who spoke on “Why would I choose Insurance as a career?”

5 Kan

Abimail Khan made a well-researched presentation explaining what was insurance and how it worked, adding that, “it is trillion dollar business that employs more than 3 million people in the United States alone.”

Insurance industry he stated was stable, dynamic and had endless opportunities which provided secure future: quoting that due to economic downturn many industries laid off workers but 12,000 positions were added to the insurance workforce in Canada.

He had also researched on insurance careers in Pakistan, gave industry statistics and role of SECP and PII in insurance and concluded with “Where there is risk, there is opportunity… Opportunity of earning as well as learning.”

Syeda Saddiqua Naqvi’s focus was on actuarial practice, and said that, “an actuary has to combine the skills of a statistician, economist and financier, and employ techniques of probability, compound interest, law, marketing, management to predict the outcome of future contingencies, and design solutions to lessen the financial severity of such events.”

She went on to talk about the expansion of life insurance business in Pakistan by 30-35 percent in the recent past, and therefore the industry was seeking dynamic people capable of delivering creative solutions and ideas in the emerging financial sector, and backed up her statement by quoting the

levels of earning possible as expressed by families of her classmates who were in actuarial business.

Muhammad Asad Khan went directly to ‘why choose insurance’, what job openings there were, and how fast was life insurance growing in Pakistan. He further elaborated by saying that “when you choose a career in insurance, you are joining an elite financial services sector that is one of the most respected in the world.”

He then went on to say that, “insurance offers learning on the job and opportunity for international professional qualification to help you reach your earning potential in a high performance environment.”

Also, that, “Personal satisfaction and growth would be at a high level as you would be managing risk, preventing loss and helping people to put their lives back together after misfortune.”

Muhammad Habib Ferozi impressed the audience with his eloquent delivery.

He spoke on why would one choose a career and if he chose insurance what would be the employment prospects.

He then elaborated on career options for actuarial science and risk management and highlighted the companies that employ actuaries, as well as other options in insurance such as underwriter, sales representative or a customer service representative.

He concluded stating that a career in insurance offered challenges, growth and a good work environment.

- all

- Gallery

Half a day seminar was organized on the above topic at the Dept. of Commerce, University of Karachi. About 100 students of B Com (Final) attended the seminar along with Chairman , Mr Tahir Ali and other faculty members.

Captain Azhar Ehtisham Ahmed was the main speaker. He gave the audience an overview of the General Insurance Market in Pakistan. Its growth trend over the past 5 years and possible job opportunities in the industry. He discussed the regulatory and Governance changes that have taken place in the industry since year 2000. He presented a typical organizational chart of an insurance company and explained its various departments. He told the audience that insurance industry is open to educated persons and young graduates. They can look forward to starting a career in insurance industry.

An insurance industry requires CAs, ACMAs, Masters, Graduates, Engineers, Actuaries, Doctors and agronomist, etc. There are 39 Non-life insurers, 9 Life insurers and 2 Health, PRCL, NICL, Brokers, Insurance Surveyors who are willing to offer jobs to young graduates.

Mr Zain Ibrahim, Deputy Executive Director, EFU General Insurance Ltd. focused on the life insurance industry. He talked about the concept of life insurance. He emphasized on the promise that relates to need and the need is then translated into an insurance product. Life insurance is sold not bought i.e. the person has to be convinced on the need. Technology advancement is playing its role in making it more reachable through the internet, mobile phones, etc. Young graduates can pursue their careers in marketing, sales, human resource, underwriting, business analysts, finance and IT depts.

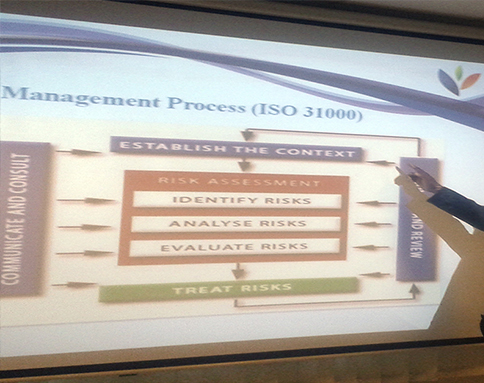

In the third presentation M Vaqaruddin, Faculty Member, PII touched briefly on the topic of Takaful which runs on Sharia principles. Its main idea is promoting brotherhood among masses by which they help each other in time of need.

This was followed with a question answer session by the participants. Questions were ably taken by the panel of insurance industry which included besides the above three presenters, Mr Uzair Mirza, Executive Vice President, Jubilee General Insurance Co. Ltd. and Mr Kamran Arshad Inam, Deputy Executive Director, EFU General Insurance Ltd. A lot of enthusiasm was witnessed among participants who were keen to know more about Insurance Industry and how it works with possibility of getting jobs there.

Mr Tahir Ali, Chairman, Commerce Dept. gave a vote of thanks to PII and Insurance Industry for making this presentation which helped them in understanding the insurance industry better. He hoped if we could arrange more such seminars. He also hinted on the possibility of arranging short courses at the university on similar lines that are arranged in the institute from time to time.

- all

- Gallery