To promote educational and knowledge sharing activities in the field of insurance, the Pakistan Insurance Institute (PII) was set up in 1951 by the insurance fraternity of Pakistan.

In 1953, PII was affiliated with the Chartered Insurance Institute (CII), London and commenced conducting Associateship and Fellowship examination of the CII.

In 1971, PII was incorporated as a registered company

Vision

A centre of academic excellence in the discipline of Takaful/Insurance in Pakistan

Mission

To set standards of professional excellence by:

Designing and implementing effective HR development programmes for the insurance industry

Broadening the membership of the Institute

Objectives

- Be the primary organization for imparting insurance education in the country and a credible source for developing insurance professionals to address the manpower requirements at various levels within insurance and related industries

- Be a seat of higher learning in the discipline of insurance, duly recognized by HEC and other renowned international insurance institutes.

- Become a credible forum for exchange of views among professionals both within and outside Pakistan

Council

PII is governed by a Council comprising of following members elected for 2023-2025:

| List of Council Members of PII | |||

| S. No | Name | Nominated by | Status |

| 1 | Mr. Khalid Hamid | National Insurance Co Ltd. | Chairman |

| 2 | Mr. Kausar Ali Zaidi | Ministry of Commerce | Member |

| 3 | Dr. Aftab Imam | State life Insurance Co. | Member |

| 4 | Mr. Shoaib Javed Hussain | State life Insurance Co. | Member |

| 5 | Mr. Tariq Aziz | National Insurance Co Ltd. | Member |

| 6 | Mr. Waseem Khan | SECP | Member |

| 7 | Mr. Farmanullah Zarkoon | Pakistan Reinsurance Co Ltd. | Member |

| 8 | Mr. Muhammad Junaid Moti | Pakistan Reinsurance Co Ltd. | Member |

| 9 | Syed Ather Abbas | Habib Insurance Co.-IAP | Member |

| 10 | Mr. Humzah Chaudhri | Chubb Insurance Co.- IAP | Member |

| 11 | Mr. Azeem Iqbal Pirani | Pak Qatar Family Takaful Co.-IAP | Member |

| 12 | Mr. Shahzad Farooq Lodhi | CEO–Pakistan Insurance Institute | Management |

| 13 | Mr. Ather Rahat Siddiqui | ED–Pakistan Insurance Institute | Management |

Academic Council

This was set up in 2017 with the objective of identifying the training needs and requirements of the insurance industry and reviewing the already developed courses being offered at PII to guide the Institute in designing new courses for the workforce of the industry.

The Academic Council comprises of 7 members (5 from the Council and 2 representing educational institutions) who are appointed on an honorary basis for a term of 3 years.

Management

Chief Executive Officer

Executive Director

PAST, PRESENT & FUTURE

Educational & Knowledge Sharing Activities

Proficiency in Insurance Programme was conducted in mid 70’s and junior level employees of the insurance industry attended the course.

Diploma in Insurance (in affiliation with the Sind Board of Technical Education) 2 year programme for 7 batches was held in 90’s and successful candidates were awarded the diploma.

Agents Foundation Course: Insurance Rule 26 of Securities & Exchange Commission (Insurance) rules 2002 lays down the requirement for any person working as an insurance agent in life and non-life business to attend the foundation course, without which they will not be able to operate as an agent. The course developed in 2003 is being regularly conducted every quarter in various cities of Pakistan.

Agents Foundation Course (Refresher):

Pakistan Insurance Institute (PII) has been approved by Securities & Exchange Commission of Pakistan (SECP) Circular No.25 of 2015 along with Notification dated July 2, 2015 and Circular No.33 of 2015 dated September 7, 2015 as a recognized Institute allowed to register and offer training and certification programs of the foundation course for life and non- life insurance agents as required under Rule 26 (b) of SEC (Insurance) Rules, 2002. The agents or designated person shall also be required to attend a refresher course after every two years from such institute(s) as specified by the Commission for the purposes of continued professional education.

Takaful General / Family: Following approval from SECP vide circular no. ID/TAKAFUL TRAINING/2015/6976, a course titled ‘Takaful Operators and Window Takaful Operators’ is being conducted every quarter and is taught by PII faculty Mufti Zeeshan Abdul Aziz.

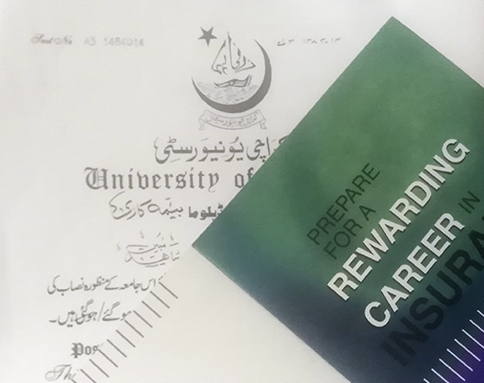

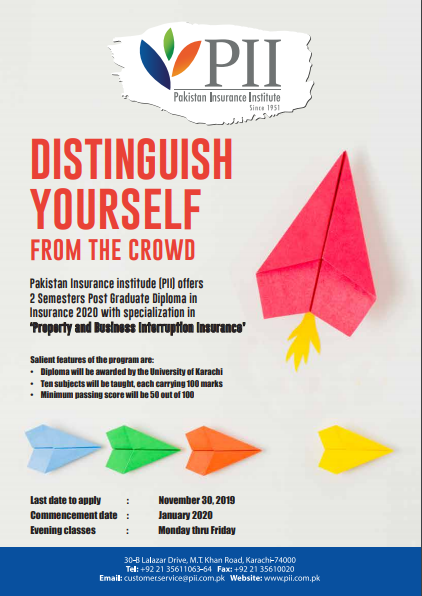

2 Semester Post Graduate Diploma Program (PGD) in Insurance

(in affiliation with University of Karachi)

Since 2010, this program offers specialization in:

Property and Business Interruption Insurance

Marine and Transport Insurance

Motor, Liability and Miscellaneous Insurance

Actuarial Science

Life Insurance

Insurance Day: A seminar on a relevant topic related to insurance is conducted every year at an educational institution in Karachi and Lahore. Press briefing is also held on this occasion at the Press Club.

International Insurance Conference:

Since 2010, Pakistan Insurance Institute (PII) has had the honour of hosting International Insurance Conferences every two years and to date four international conferences have been held on the following topics:

April 2010 Political Violence

April 2012 Catastrophe Events – Challenge for the Insurance Industry

April 2015 Challenges & Opportunities for the Insurance Industry in Emerging Markets

April 2017 Climate Change and Emerging Risks

April 2019 InsurTech & Microinsurance

Chartered Insurance Institute (CII)

Certificate /Diploma /Advanced Diploma Examination of Chartered Insurance Institute conducted by PII are held in April and October each year

Tutorial classes are held in March and September for assisting candidates in preparation for the exams.

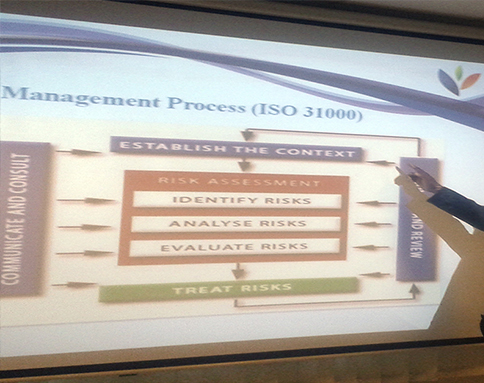

Continuous Professional Development Programs (CPD)

Continuing Professional Development (CPD) is essential for every professional, ensuring you keep your skills and knowledge up-to-date and in turn remain competent. Workshops and seminars for insurance professionals on different topics (both insurance related and soft skills) are held regularly throughout the year.

Participants to the workshops can avail credits from CII towards CPD.